Medicare Help, Made Local

Helping You Put Together Your Medicare Puzzle

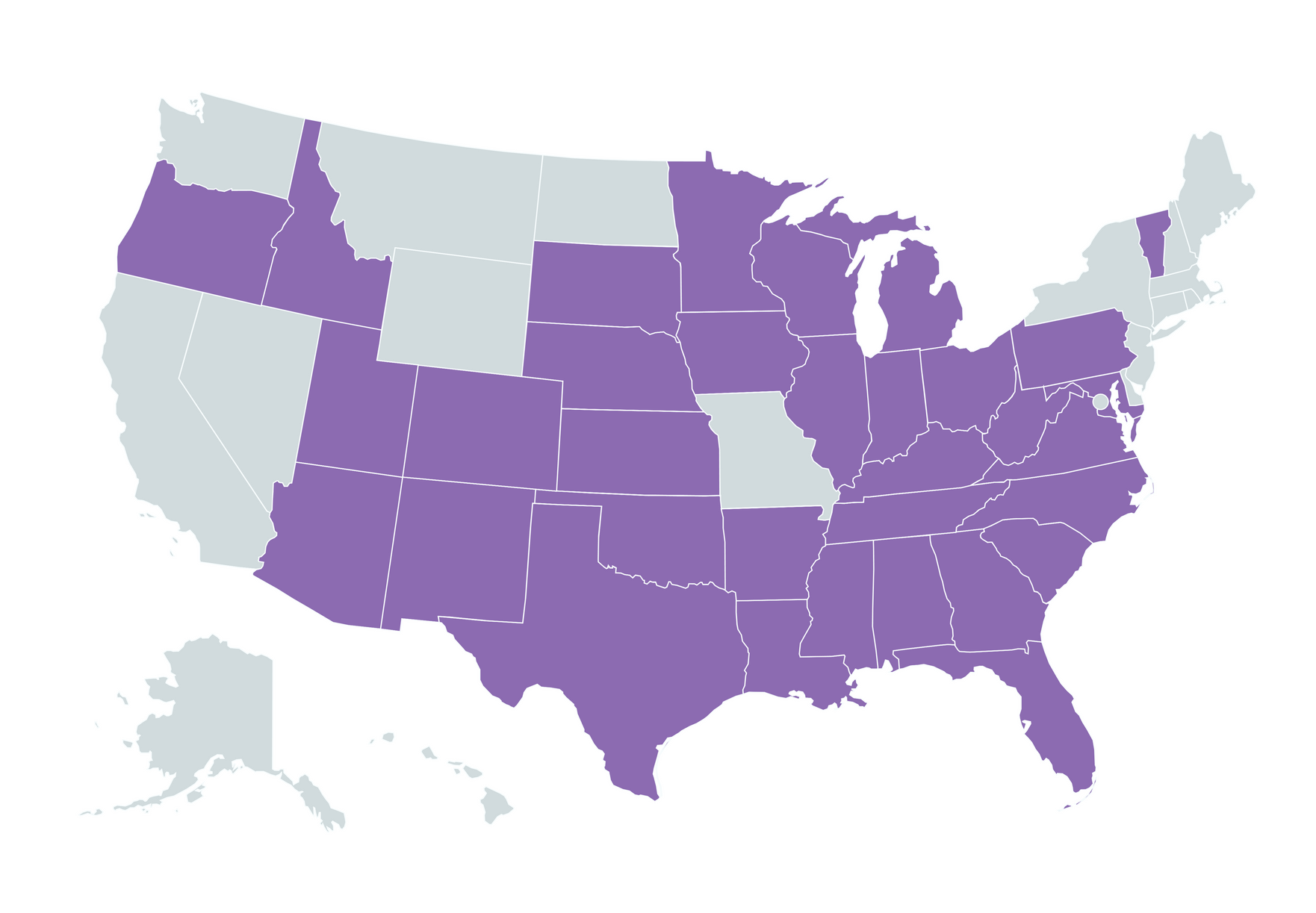

If you’re looking for a local Medicare agent in southeastern Michigan, you’re in the right place. We’re an independent Medicare agent in Michigan that compares multiple carriers, explains the trade-offs in plain language, and helps you enroll when you’re ready—no sales pressure. We also support clients across 33 other states, with convenient phone and video appointments when needed.

Why Medicare Benefits Group?

Our service is free. We work for you, not the insurance companies. We do all the paperwork, ensure your doctors are in network, and review your account every year to determine if your plan needs to be adjusted based on medical changes or if we can find you additional savings.

Independent One-Stop Shop

We are licensed with many of the top insurance carriers nationwide, which means you will receive multiple options based on your individual needs and budget.

Unbiased Advice

As trusted and knowledgable professionals we provide you with all the pros and cons of your options, never steering you towards something you do not need or want.

Custom Prescription Drug Lookup

We lookup your current medications to ensure you have the right plan for you, helping you save money when combining premiums, deductibles, and copays.

WE SHOP THE RATES FOR YOU

We shop the rates for you. The carrier rates through us are the same as if you called the insurance company direct. The carriers pay us directly so there are no markups when purchasing a plan through us.

How Original Medicare Works

Medicare is the Federal health insurance program for:

- People who are age 65 or older

- Certain younger people with disabilities

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD).

There are two different parts of Original Medicare that help cover specific services which are referred to as Part A and Part B. For a summary of premiums, deductibles, coinsurance, and other costs associated to Part A and Part B, click here →

Medicare Part A (Hospital Insurance)

In general, think of this like ‘room and board’ when you’re in the hospital. This is an entitlement benefit, meaning most people are entitled to their Part A at age 65 because they have paid into Social Security and Medicare as part of their income taxes every year and therefore are entitled to Part A premium-free. The deductibles, coinsurance, and out-of-pocket costs within Part A can quickly add up.

Medicare Part B (Medical Insurance)

Most people associate Medicare coverage with Part B because this is the major medical, or ‘doctoring,’ part. This includes services such as doctor visits, labs, x-rays, CT’s, surgeon fees, physical therapy, and everything in between. In 2025, most people will pay a monthly premium of $185.00 for Part B. Higher income earners will pay more due to an Income-Related Monthly Adjustment Amount, or IRMAA. The Part B premium deducts automatically out of a beneficiary’s Social Security income, or if the SSI is deferred, the Social Security Administration will mail a bill (usually quarterly). This premium gives the Medicare beneficiary 80/20 major medical coverage: Medicare pays 80% of major medical costs, leaving the Medicare beneficiary responsible for the other 20%, with no maximum out of pocket. Also, Part B's deductible in 2025 is $257 for the calendar year.

Explore Our Services

Medicare Advantage Plans (Part C)

These plans provide all of your Part A and Part B benefits, which include hospital and medical coverage. Most Advantage plans include Part D Prescription Drug coverage and usually include many additional benefits not covered by Original Medicare.

Medicare Supplement (Medigap) Insurance

These plans help pay for healthcare costs such as co-pays and deductibles. They help fill the ‘gaps’ of Original Medicare with the freedom to go to any doctor in the U.S. that takes Medicare.

Medicare Prescription Drug Plans (Part D)

Part D coverage is obtained as a standalone prescription drug plan or included in a Medicare Advantage (Part C) plan that offers coverage for medication costs. These plans are tailored to fit your specific needs and budget.

Other Insurance Services

We can also help you explore insurance plans that fill in the gaps Medicare doesn’t cover. This includes options for dental, vision, hearing, and other supplemental needs. If you're looking for more complete protection without the confusion, we’ll explain your options simply and help you choose what makes sense for your lifestyle and budget.

Here’s What Our Clients Are Saying

We believe good service speaks for itself—and so do the people we’ve helped. Below are just a few kind words from individuals who turned to us for clear, one-on-one Medicare support. Check out more review here!

Recent 5 Star Reviews from Google

States We Insure

Medicare Benefits Group is proud to call Commerce Township home while helping people across Michigan and 33 other states. If you or family live nearby in southeastern Michigan—or are moving out of state—we can still walk you through your choices and enrollment.

frequently asked questions

Quick Answers to the Questions We Hear Most

What’s the difference between an agent and a broker?

An independent broker compares plans from multiple carriers at no extra cost to you—the carrier pays the commission.

When can I change my plan?

During Open Enrollment (Oct 15–Dec 7). If you’re already in Medicare Advantage, changes may be allowed Jan 1–Mar 31. Special Enrollment Periods can apply after moves or qualifying events.

Do you charge a fee?

No. There’s no charge to meet, compare options, or enroll.

Do you work outside Commerce Township?

Yes—Novi, Farmington Hills, Milford, and throughout Michigan, plus 33 other states.

Can you work with my doctors?

Yes. We verify provider networks and check prescriptions before recommending any plan.

Licensed with Top Carriers in 34 States

We shop the top insurance companies so you don’t have to.

Let’s Talk Coverage

Clear Medicare Help, Tailored to You

Medicare shouldn’t feel overwhelming. From your first questions to plan comparisons and enrollment, you get a single point of contact who listens and makes sure doctors and prescriptions are checked before any decision is made. We’re based in Commerce Township and serve neighbors across southeastern Michigan in nearby communities like Novi, Farmington Hills, and Milford, and 33 other states.